Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social the petty cash account cash short and over is a permanent account. Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

How is a petty cash voucher properly filled out?

The next step is to enter both an expense and an asset account on your books under “petty cash”. If you are reimbursed $20 for postage expenses, debit postage expense $20 and credit cash $20. The entry to record the reimbursement would debit the expense accounts reported by the custodian. The greatest degree of internal control can be maintained when a petty cash fund under the control of one individual is established to handle these expenditures. The reconciliation process ensures that the fund’s remaining balance equals the difference between the original balance minus charges detailed on receipts and invoices. If the remaining balance is less than what it should be, there is a shortage.

What types of expenses are appropriate for petty cash usage?

Check out 5 tips for securing the capital you need to scale your business. It can streamline your financial processes and save valuable time and resources when managed correctly. It’s not just about having a few dollars on hand; it’s about creating a system that balances convenience with accountability. Let’s dive into its world and discover how this financial resource can become your small business’s secret weapon for efficiency and flexibility. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Replenish Petty Cash

By exercising vigilance and implementing robust internal controls, businesses can effectively manage petty cash funds and minimize the likelihood of theft, shortages, and errors. A firm should note instances of cash variances in a single, easily accessible account. This cash-over-short account should be classified as an income-statement account, not an expense account because the recorded errors can increase or decrease a company’s profits on its income statement.

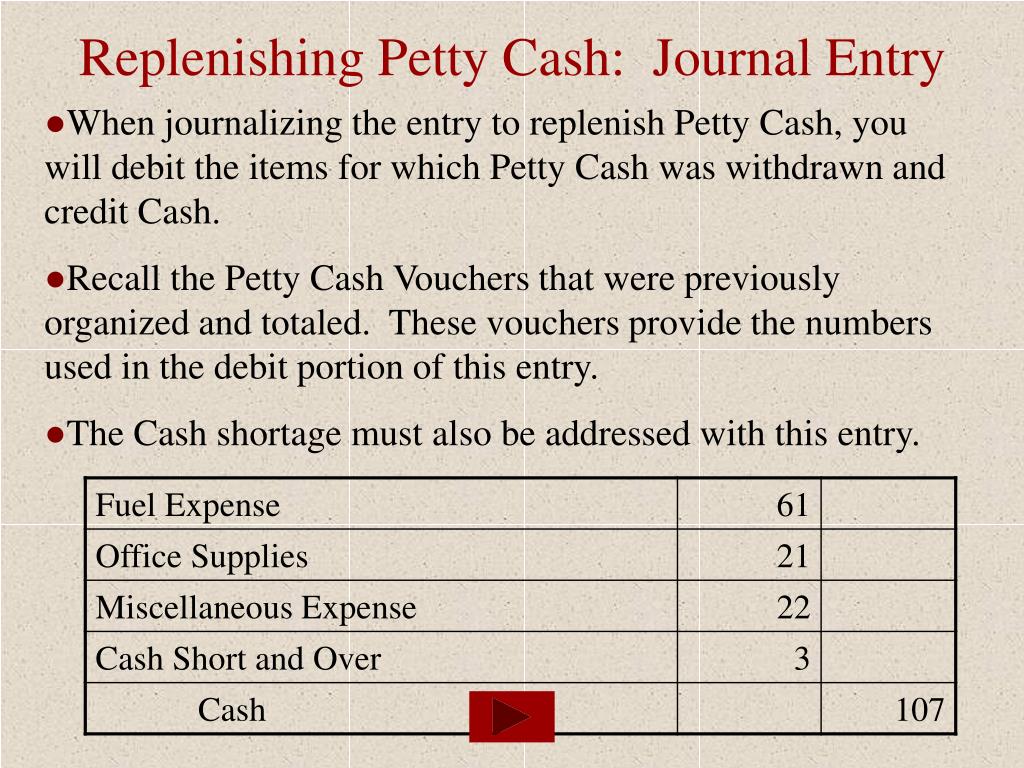

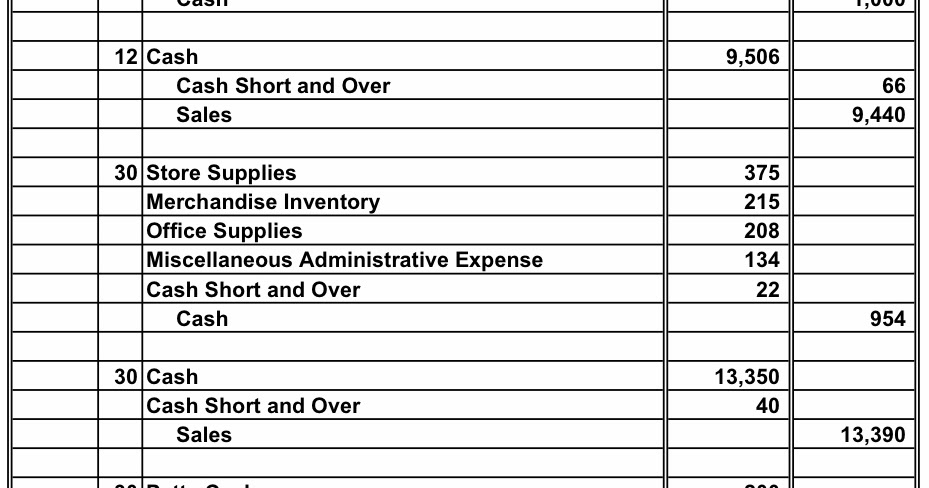

Companies replenish the petty cash fund at the end of the accounting period, or sooner if it becomes low. The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts until the check is written and a journal entry is made. (Sometimes we refer to this fund as an imprest fund since it is replenished when it becomes low.). To determine which accounts to debit, an employee summarizes the petty cash vouchers according to the reasons for expenditure. The journal entry to record replenishing the fund would debit the various accounts indicated by the summary and credit Cash.

- The petty cash fund is reconciled periodically to verify that the balance of the fund is correct.

- Also, the debit of cash over and short represents the loss, e.g. a few dollars, due to the cash being less than the amount it is supposed to be when comparing the sales records.

- A company uses a cash over and short account to show a discrepancy between the company’s sales records and other reported figures and its audited accounts.

- Transitioning to digital solutions for petty cash management has numerous benefits, such as increased efficiency, improved tracking, and reduced manual entry errors.

This net debit represents a loss to the business for inventory damaged but not covered by the insurance claim. No matter how careful a business owner tries to be or the quality of the business’ security system, a business can still become the victim of theft. Theft of assets must be recorded on the accounting books in order to properly reflect the loss of the asset and the resulting cost of the loss. Without strict controls, employees might be tempted to use that cash on hand for personal expenses or fabricate receipts.

In this case, we need to make the journal entry for cash shortage at the end of the day or when we make the replenishment of petty cash if there is less cash on hand than the amount it is supposed to be. A controller conducts a monthly review of a petty cash box that should contain a standard cash balance of $200. He finds that the box contains $45 of cash and $135 of receipts, which totals only $180. This cash shortfall is recorded as a debit to the cash over and short account (which is an expense) and a credit to the petty cash or cash account (which is an asset reduction). A petty cash account is an account a company uses to pay for small expenses.

Petty cash is a current asset and should be listed as a debit on the company balance sheet. Tracking Cash Over and Short is an important piece of protecting a company’s most valuable asset, Cash, from theft and misuse. It may seem like a small item to track, but think of it from the point of view of a retail or restaurant chain where millions of dollars pass through the cash registers every day. Every time a register is short, the company’s expenses increase and profits decrease.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

By allocating a fixed amount to a sundry fund, businesses can better control and predict small-expense spending. For small and medium-sized businesses (SMBs), deciding whether to implement a petty cash system requires careful consideration. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

However, on corporate financial statements, petty cash is listed in the “Cash and cash equivalents” section of the balance sheet. By implementing a well-structured system, you can streamline operations, improve cashflow management, and maintain better control over minor expenditures. Petty cash is a small amount of money kept on hand by a business to cover minor, day-to-day expenses. In this case, when we replenish the petty cash, we just need to refill $77 ($100 – $23) as we still have $23 remaining in petty cash. The custodian of the petty cash fund is in charge of approving and making all disbursements from the fund.