Small Business Accounting Software Start for Free

Accounting software helps business owners understand how money flows in and out of their businesses. This can help you save time and make financial decisions quickly. These features help keep our invoicing, and accounting, free. You can effectively analyze the financial health of your business, find ways to generate more profit, and move forward with your business plan. Our accounting and invoicing features are currently free.

Manage your money like a boss.

Wave is also PCI Level-1 certified, which is often necessary with third-party merchant service providers. Create graphs, charts, and dashboards to see at a glance where your income is coming from and which expenses are cutting into your bottom line. You can then dig down as deep as you like with expense tracking and customized reports to manage your revenue, categorize expenses, and find cost-cutting opportunities. You’ll also experience peace of mind knowing your personal financial information is backed-up and secure. Once you’re approved, you can turn payments on or off for any invoice, or pick default settings for all invoices. Set up recurring invoices for your finance clients and safely store credit card info so you have one less thing to keep track of.

Get your money and get on with your day

And even better, get rid of late payments with Wave’s Pro Plan features like automated reminders and recurring invoices. Create beautiful invoices, accept online payments, and make accounting easy—all in one place—with Wave’s suite of money management tools. Our invoicing, online payments, accounting and bank connection features give you a unified view of your income and expenses – no need to log in to multiple apps or tools. Wave invoices are integrated with our accounting software, so payments are recorded for you – which means less bookkeeping and tax season prep.

Button-up your bookkeeping

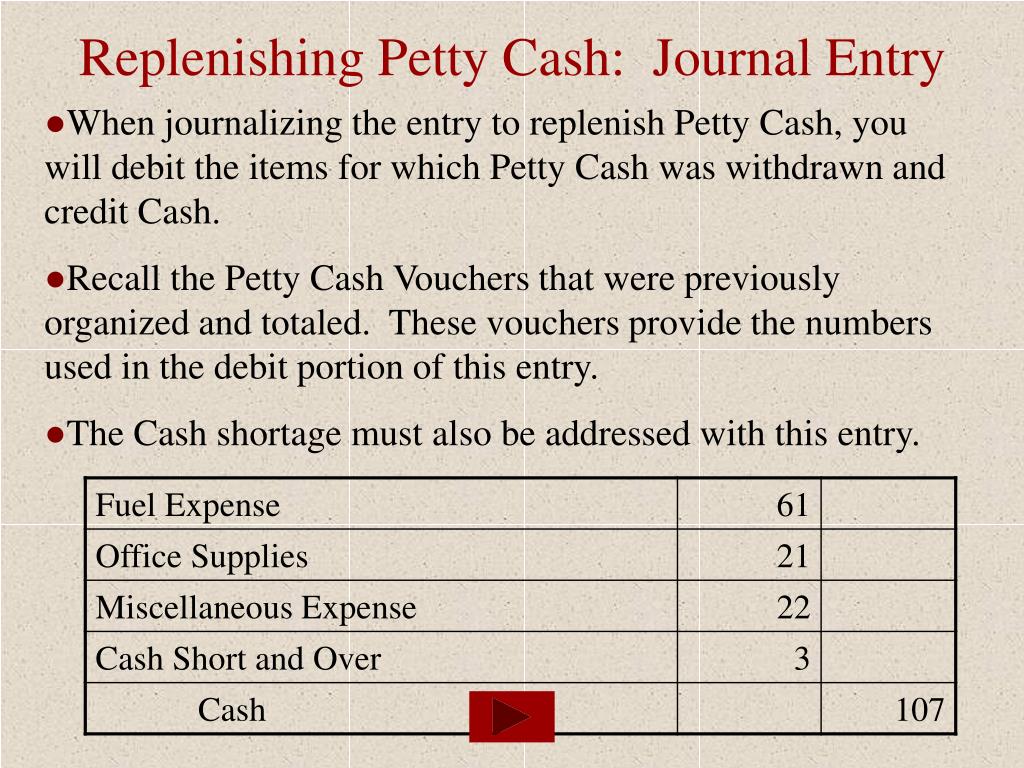

Automate overdue reminders, set up recurring billing, and add notes or terms of service with ease. Our money management tools are easy to use separately and more powerful together. Our money management tools are easyto use separately and more powerfultogether. Yes, switching from other accounting apps or products to Wave is easy! See our step-by-step guide on how to import bookkeeping data into Wave here.

- Wave is PCI Level-1 certified for handling credit card and bank account information.

- Bank data connections are read-only and use 256-bit encryption.

- Our invoicing, online payments, accounting and bank connection features give you a unified view of your income and expenses – no need to log in to multiple apps or tools.

Since Wave uses accountant-approved, real double entry accounting, your accountant will have all the information they need. With a Pro Plan subscription, you can connect your bank account with Wave and automatically import your transactions. Bank data connections are read-only and use 256-bit encryption. Servers are housed under physical and electronic protection. Wave is PCI Level-1 certified for handling credit card and bank account information. Wave’s smart dashboard efficiently organizes your income, expenses, payments, and invoices for fast and accurate tax preparation.

Enable invoice payments by credit card for a pay-as-you-go fee as low as 2.9% + 60¢, and watch the money roll in. Instant Payout is an additional service offered by Wave subject to user and payment eligibility criteria. A 1% fee is applied to the amount you withdraw from your available balance, in addition to regular processing fees. Deposits are sent to the debit margin of safety formula calculation example and faqs card linked to your account in up to 30 minutes.

In some cases, we may hold funds and request more information if we need it for the protection of your business and Wave’s. We built our Payroll tool for small business owners, so it’s easy to use AND teaches you as you go. Quickly create and send unlimited invoices, look like a pro with customizable templates, and get paid fast with online payments. You can upgrade to Pro and add features as you need them, like bank account connections and real-time transaction updates, and you can easily make changes as your requirements change. You can also choose from Wave’s selection of professional invoice templates to make sure every touch point instills client confidence in your brand.

.jpg)